Summary

Table of Content

Aerogel Insulation Market

Get a free sample of this report

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Request Sectional Data

Thank you!

Your inquiry has been received. Our team will reach out to you with the required details via email. To ensure that you don't miss their response, kindly remember to check your spam folder as well!

Form submitted successfully!

Error submitting form. Please try again.

Aerogel Insulation Market Size

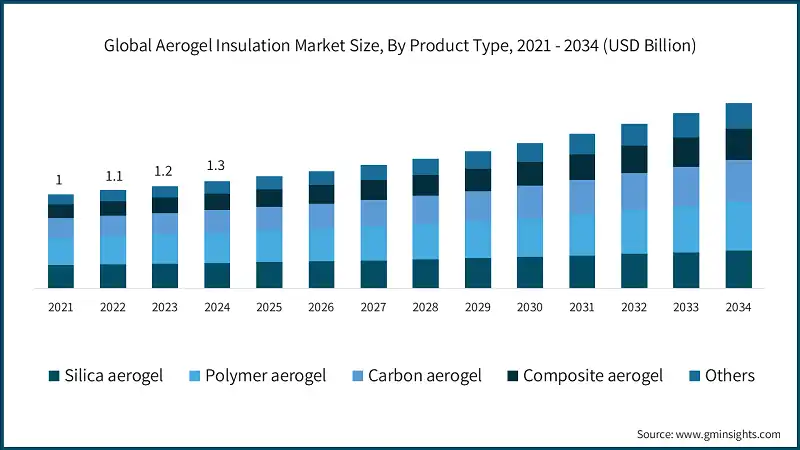

The global aerogel insulation market was valued at USD 1.3 billion in 2024 and is estimated to grow at a CAGR of over 10% from 2025 to 2034, driven by increasing demand for energy-efficient solutions across industries. One of the primary demand drivers is the growing emphasis on energy efficiency across industries.

To get key market trends

To get key market trends

Aerogel insulation's exceptional thermal properties make it an ideal choice for reducing energy consumption and improving building and industrial insulation. With stringent environmental regulations and rising awareness about sustainability, companies and governments alike are pushing for more energy-efficient construction materials. Aerogel, with its lightweight and highly insulating properties, is increasingly replacing traditional insulation materials like fiberglass and foam, especially in high-performance applications where energy savings are crucial, such as in the construction of eco-friendly buildings, refrigeration systems, and transportation.

Aerogel Insulation Market Report Attributes

| Report Attribute | Details |

|---|---|

| Base Year: | 2024 |

| Aerogel Insulation Market size in 2024: | USD 1.3 billion |

| Forecast Period: | 2025 – 2034 |

| Forecast Period 2023 - 2032 CAGR: | 10 |

| 2023 Value Projection: | USD 3.5 billion |

| Historical Data for: | 2021 – 2024 |

| No of Pages: | 220 |

| Tables, Charts & Figures: | 180 |

| Segments Covered: | Product Type, Form, Temperature Range, End-use, Distribution Channel and Region |

| Growth Drivers: |

|

| Pitfalls Challenges: |

|

What are the growth opportunities in this market?

Aerogel Insulation Market Trends

As the aerogel manufacturing process advances, there has been a noticeable trend of decreasing production costs. Previously, aerogels were considered expensive materials due to complex manufacturing processes, but with innovations in production methods and scaling up of industrial applications, manufacturers may reduce costs. The development of composite aerogels, which combine silica with other polymers or materials to improve flexibility and strength, has further enhanced aerogel’s applicability and affordability. These advances are driving the expansion of aerogel insulation into more industries, especially those that require lightweight, durable, and thermally efficient materials without compromising on cost-effectiveness.

Aerogel Insulation Market Analysis

Aerogels, particularly silica aerogels, have a low thermal conductivity, making them ideal for industries that require high-performance insulation to handle extreme temperatures. In aerospace, for example, aerogel is used to insulate spacecraft, satellites, and components exposed to harsh conditions, where traditional insulation materials would be too heavy or inefficient. Similarly, in the automotive sector, aerogels are being used to reduce vehicle weight, contributing to energy efficiency and improved fuel economy.

As vehicle manufacturers strive for lightweight materials that do not compromise safety or performance, aerogel insulation is emerging as a leading solution, particularly for engine compartments and exhaust systems. The oil and gas industry also plays a major role in driving the demand for aerogel insulation. With rising energy consumption and exploration activities in extreme environments like offshore drilling and Arctic regions, there is an increasing need for insulation materials that can withstand high temperatures, mechanical stress, and harsh weather conditions.

Learn more about the key segments shaping this market

Based on product type, the silica aerogel segment accounted for revenue of around USD 687.5 million in 2024 and is estimated to grow at a CAGR of around 10.2% from 2025 to 2034. Silica aerogel offers extremely low thermal conductivity, making it the material of choice for high-performance insulation in applications requiring superior thermal resistance. Its ability to provide excellent insulation in a lightweight form is a key factor driving demand. Silica aerogel’s non-flammability and ability to absorb sound have made it popular in applications requiring fire protection and soundproofing. Industries such as oil and gas, aerospace, and automotive are increasingly adopting silica aerogel for fireproofing and acoustic insulation.

Learn more about the key segments shaping this market

Based on form, the blankets segment held around 45% share of the aerogel insulation market in 2024 and is anticipated to grow at a CAGR of 4.3% during 2025 to 2034. Aerogel blankets offer excellent thermal insulation properties while being lightweight and flexible. They can be easily wrapped around irregular shapes, making them ideal for applications in industrial insulation (e.g., pipes, tanks, and reactors) and aerospace applications (e.g., insulating spacecraft and satellite components).

Looking for region specific data?

U.S. region dominated around 82% share of the North America aerogel insulation market in 2024. North America's vast manufacturing sector, especially in industries such as chemical processing, petrochemicals, and refining, requires materials that can withstand extreme temperatures while improving energy efficiency. Aerogel’s ability to provide high-performance insulation in industrial settings is leading to its increased adoption in these industries.

Aerogel Insulation Market Share

In 2024, key companies like Aspen Aerogels, Aerogel Technologies, Cabot Corporation, BASF, Saint-Gobain, Dow, Armacell and Johns Manville held a combined market share of 15%-20%. These companies are actively engaging in mergers, acquisitions, facility expansions, and collaborations to enhance their product portfolios, reach more customers, and strengthen their market positions.

Resellers that consistently deliver high-quality products and reliable performance often secure a competitive advantage. Upholding stringent testing and refurbishment standards is crucial for earning customer trust. Introducing warranties or return policies can distinguish resellers in the market. By offering customer support and repair services, resellers bolster buyer confidence, rendering them more appealing. A robust online presence, characterized by user-friendly websites and active social media engagement enables resellers to connect with a wider audience. Strategic marketing initiatives can further differentiate them from their competitors.

Aerogel Insulation Market Companies

Major players operating in the aerogel insulation industry are:

- Aerogel Systems

- Aerogel Technologies

- Armacell

- Aspen Aerogels

- BASF

- Cabot Corporation

- Dow

- Guangdong Alison

- Jios Aerogel

- Johns Manville

- KCC Corporation

- Nanoveu

- Saint-Gobain

- Solvay

- ThermoDyne Systems

Aerogel Insulation Industry News

- In June 2023, Aspen Aerogels, Inc. unveiled a state-of-the-art engineering and rapid prototyping facility in Marlborough, Massachusetts.

- In May 2023, Cabot Corporation rolled out ultra-thin thermal barrier products, ENTERA EV5200, ENTERA EV5400, and ENTERA EV5800, tailored for Lithium-Ion Batteries.

- In September 2023, Beerenberg AS forged a distribution pact with aerogel-it GmbH, aiming to launch Oryza Aerogel insulation products in Europe.

- In March 2023, Enersens boosted the production capacity of its SKOGAR products, celebrating its victory in the EIC Accelerator program.

This aerogel insulation market research report includes in-depth coverage of the industry with estimates & forecast in terms of revenue (USD Billion) & volume (Thousand Units) from 2021 to 2034, for the following segments:

Market, By Product Type

- Silica aerogel

- Polymer aerogel

- Carbon aerogel

- Composite aerogel

- Others

Market, By Form

- Blankets

- Panels

- Granules

- Coatings

- Others (foam, etc.)

Market, By Temperature Range

- Low temperature insulation (<100°C)

- Medium temperature insulation (100°C - 500°C)

- High temperature insulation (>500°C)

Market, End Use

- Building & construction

- Oil & gas

- Aerospace

- Automotive

- Industrial insulation

- Electronics

- Others

Market, Distribution Channel

- Direct

- Indirect

The above information is provided for the following regions and countries:

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Latin America

- Brazil

- Mexico

- MEA

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Question(FAQ) :

Who are the major players in the aerogel insulation market?

Key players in the aerogel insulation market include Aerogel Systems, Aerogel Technologies, Armacell, Aspen Aerogels, BASF, Cabot Corporation, Dow, Guangdong Alison, Jios Aerogel, Johns Manville, KCC Corporation, Nanoveu, Saint-Gobain, Solvay, and ThermoDyne Systems.

What trends are driving the North America aerogel insulation market?

The U.S. dominated 82% of the North America aerogel insulation market in 2024, led by the region's extensive manufacturing sector and the need for high-performance insulation in industries like chemical processing and petrochemicals.

What is the revenue of the silica aerogel segment?

The silica aerogel segment generated USD 687.5 million in 2024 and is expected to grow at a CAGR of 10.2% from 2025 to 2034, owing to its low thermal conductivity and superior insulation properties.

How big is the aerogel insulation market?

The global market for aerogel insulation was reached USD 1.3 billion in 2024 and is projected to grow at a CAGR of over 10% from 2025 to 2034, driven by increasing demand for energy-efficient solutions across industries.

What is the market share of aerogel blankets?

The aerogel blankets segment held a 45% share of the aerogel insulation market in 2024 and is anticipated to grow at a CAGR of 4.3% from 2025 to 2034, as they offer lightweight, flexible, and high-performance insulation for industrial and aerospace applications.